workers comp taxes texas

Household employers in Texas are not required to carry a workers compensation insurance policy however we recommend doing so. The forms are also available in individual listings.

Workers Compensation Insurance Cost Calculator How Much For A Small Business Policy

The benefits from workers compensation are typically not taxable in Texas.

. You are not subject to claiming workers comp on taxes because you need not pay tax on income from a workers compensation act or statute for an occupational injury or sickness. Workers compensation complete listing of forms. Workers Compensation Texas Law.

All employers except those in Texas must carry a form of workers comp coverage to aid employees who receive on-the-job injuries. Provides for reimbursement of medical expenses and a portion of lost wages due to a work-related injury disease or illness. Maintenance taxes are used to fund the Texas Department of Insurance its Workers Compensation Research Division and the Division of Workers CompensationOffice of Injured Employee Counsel DWCOIEC.

The insurance carrier has one goal. Obtain an instant quote and purchase a policy online or contact our partner Clarke White at 804-267-1210. For your predominant use study and tax exemption certificationOur pricing is very competitive anywhere in Texas.

To limit or dispute your medical care and your entitlement to income benefits. You pay unemployment tax on the first 9000 that each employee earns during the calendar year. The Texas Workforce Commission indicates that the effective tax rate in 2019 ranges from a minimum of 036 paid by 656 of employers to a maximum of 636 paid by 53 of employers for experienced-rated accounts and the average experience tax rate is 106.

Workers comp will also pay up to 10000 for burial expenses. Vary each year as adopted by the Texas Department of Insurance. Benefits are available only.

Your taxable wages are the sum of the wages you pay up to. You are not subject to claiming workers comp on taxes because you need not pay tax on income from a workers compensation act or statute for an occupational injury or sickness. Most income earned by Texas residents is taxable and so must be reported on their federal tax returns.

Each division and the OIEC are responsible for regulating different aspects of workers compensation insurance in Texas and each sets a. However there are some situations when this general rule does not apply. If they use independent contractors they dont have to pay payroll taxes on them or buy workers comp insurance for them.

The quick answer is that generally workers compensation benefits are not taxable. Workers Compensation Research and Evaluation Group. For instance welfare benefits and compensatory damages awarded for physical injury are not considered taxable income.

Do you claim workers comp on taxes the answer is no. See Electronic filing - online forms for more information about filing your PDF form online. It doesnt matter if theyre receiving benefits for a slip and fall accident muscle strain back injury tendinitis or carpal tunnel.

Regulate Texas workers compensation efficiently educate system participants and achieve a balanced system in which everyone is treated fairly with dignity and respect. Maximum Tax Rate for 2022 is 631 percent. The nations best care and services for injured employees and their employers.

Texas requires that all businesses involved in projects for government entities carry workers compensation insurance. We encourage you to speak with a financial professional to make sure that you follow all. Minimum Tax Rate for 2022 is 031 percent.

Requires all employers with or without workers compensation insurance coverage to comply with reporting and notification requirements under the Texas Workers Compensation Act. Subscribing to workers compensation insurance puts a limit on the amount and type of compensation that an injured employee may receive - the limits are set in the law. Texas Workers Compensation laws are complex and impact many areas of an injured workers life and future.

Similarly those who receive a workers compensation. As you can see there are limits to workers comp benefits. Insurers licensed by the Texas Department of Insurance and self-insurance groups that write workers compensation insurance coverage must pay this tax.

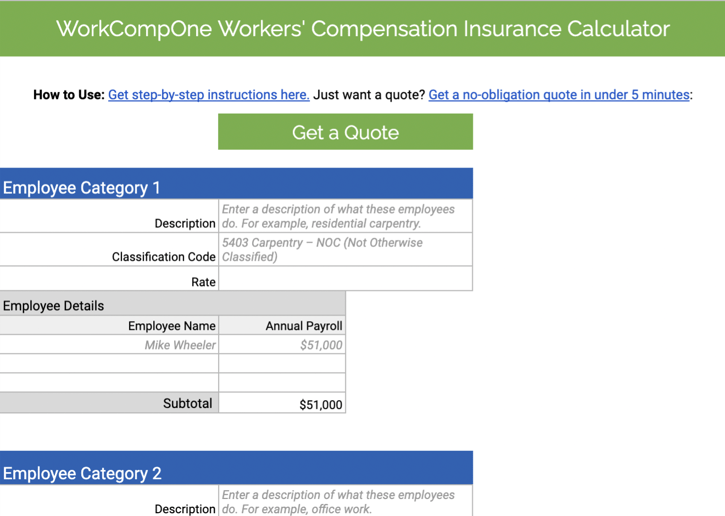

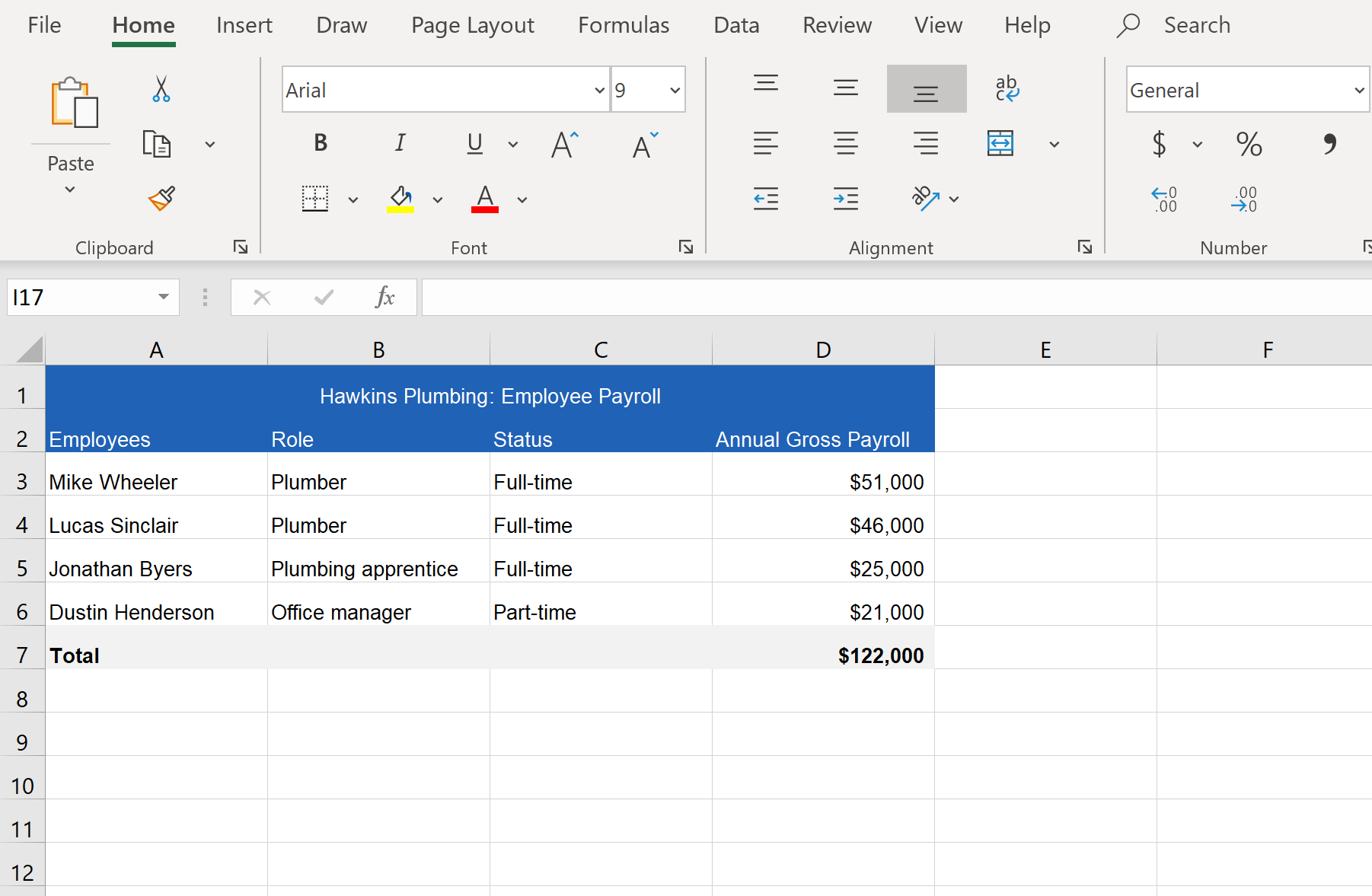

These policies pay for medical expenses and lost wages if an employee has a work-related injury or illness. In most cases they wont pay taxes on workers comp benefits. Sole-Proprietors and Partners who include themselves on a workers compensation policy must use a flat payroll amount of 63100 for rating their overall workers compensation cost.

However retirement plan benefits are taxable if either of these apply. Being a non-subscriber ie going bare or without. Youll receive only a portion of your lost wages although it may help to learn that workers comp benefits are generally tax-free.

If they use independent contractors they dont have to pay payroll taxes on them or buy workers comp insurance for them. Workers Comp Exemptions in Texas. But workers comp payments dont qualify as earnings under IRS laws.

You retire due to your occupational sickness. In our system some independent contractors get workers compensation benefits. Texas unlike other states does not require an employer to have workers compensation coverage.

Limitations of Workers Comp Benefits. In addition you cant receive any payment for the. Why use cost containment engineering Inc.

This is a complete listing of all Division of Workers Compensation Forms. Workers comp taxes texas. You do not need to claim the income benefits from workers compensation you receive on your taxes.

Texas workers compensation law has caught up to these types of games that employers play. Call 888-434-COMP 888-434-2667 and talk to our hard-working. Refer to 28 TAC Rule 1414 and our publication Insurance Maintenance Tax Rates and Assessments on Premiums.

Forms available for electronic filing are indicated by.

Workers Compensation Payroll Calculation How To Get It Right

Texas Workers Compensation Insurance Laws Forbes Advisor

What Wages Are Subject To Workers Comp Hourly Inc

Deadline For Filing Workers Comp Form Is April 30

How To Complete The Workers Compensation Form Youtube

Is Workers Comp Taxable Hourly Inc

Workers Compensation How To Apply For Compensation Benefits Marca

Are Workers Compensation Settlements Taxable

How Are Workers Compensation Benefits Calculated Foa Law

Fica Taxes Unemployment Insurance Workers Comp For Owners

What Is Workers Compensation Article

Taxable Benefits From Workers Compensation In Texas

Is Workers Comp Taxable Workers Comp Taxes

How To Reduce Workers Compensation Insurance Costs Employers Resource

Is Workers Comp Taxable Hourly Inc

Texas Non Subscriber How Can Injured Worker S Get Compensation